Millennials Are Freaking Out Because A Survey Says 1 In 6 Of Them Have $100k In Savings

While it sometimes may seem confusing, millennials have been defined as those born between 1981-1996. They're all well into adulthood now, but it hasn't been an easy-breezy ride. If you fit into this demographic you probably have a lot of ideas about what life should look like today, so let me ask you this? Do you have a bajillion dollars saved up? Okay, that's a silly question. But it's not far from the absurdity released not too long ago by Bank of America.

Bank of America put it in its 2018 Winter report: a survey shows that 16 percent of millennials (or roughly one in six 23 to 37-year-olds) have 100,000 dollars or more saved up. As soon as CNBC tweeted the fact, Millennials across the Internet definitively lost their shit.

The tweet that started the chaos.

For an entire generation of people who are collectively struggling, the concept of having any savings is almost impossible, let alone $100,000.

CNBC

CNBCIt's easy to respond with disbelief because it sounds... impossible.

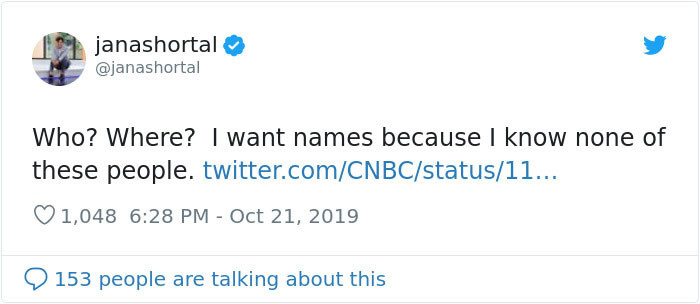

janashortal

janashortal...Because this is more plausible since so many of us grew up playing The Sims.

davidmackau

davidmackauA more likely result:

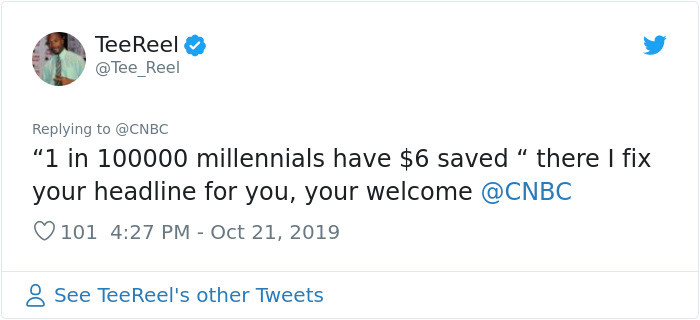

Tee_Reel

Tee_ReelIn an interview with Bored Panda, Sam Dogen, a financial expert behind the blog Financial Samurai said:

I absolutely believe more than 1 in 6 millennials should have at least 100,000 dollars or more saved up if they ever want to achieve financial independence and not work at a job they hate for the rest of their lives. giphy

giphyCollege debt is staggering for Millennials.

stillgray

stillgrayIf the bills even get paid...

KariVanHorn

KariVanHornDogen also said:

Based on my 401(k) savings by age guide, you should have the following saved in your pre-tax retirement account by age:-100,000 – 300,000 dollars by age 30-250,000 – 1,000,000 dollars by age 40-600,000 – 2,250,000 dollars by age 50-1,000,000 – 5,000,000 dollars by age 60. giphy

giphySavings? Did you mean debt?

ZhugeEX

ZhugeEX

Some people think that perhaps the bank's survey wasn't a large enough pool of people, because it cannot be accurate.

Braunger

Braunger

Dogen told Bored Panda:

If you want to retire before 60, you need to save even more in online brokerage account and other non-tax advantageous accounts. You can’t withdraw funds from your 401(k) or IRA before 59.5 without a 10% penalty.Dogen also offers a guide for "after tax investment amounts by age."

giphy

giphy

To put this into much better perspective, the survey is basically moot.

KorinaLMoss

KorinaLMoss

If you know, you know.

apathetic_NY

apathetic_NY

Dogen also advises that your mindset matters, he said:

You have to get in the right money mindset. If you are already telling yourself it is impossible to save money, of course, you’re not going to do everything possible to save money. My #1 piece of advice is: if the amount of money you’re saving each month doesn’t hurt, you’re not saving enough. giphy

giphy

The jokes rolled in on Twitter.

GMSarli

GMSarli

Quite frankly, almost any millennial out there can resonate with the hysterical responses.

thistallawkgirl

thistallawkgirl

Hey, BOA, we're gonna need some more details.

pdacosta

pdacosta

Dogen also advised what to do next:

After you make saving money painful, then you’ve got to take on side hustles to make even more money. Freelancing online, driving a car, assembling furniture, tutoring, mowing lawns are examples of some common side hustles. giphy

giphy

Disclaimer, wink-wink.

LukeBarnett

LukeBarnett

Honestly... same.

PNWHeathen

PNWHeathen

*laughs in depression*

camrocker

camrocker

The Financial Samurai encourages you, that you can adapt:

The absolute bare minimum is to save at least 20 percent of your income after tax each month. If 20 percent feels like a lot, don’t worry. You will get used to living with 80 percent of your income or working other jobs to boost your income. tenor

tenor

The doubt is intensifying.

spokanehouse

spokanehouse

Dogen said:

If 20 percent doesn’t feel like enough, it’s imperative you keep ratcheting up your savings rate until you need to make lifestyle changes. Your ultimate goal is to try and achieve a 50 percent savings rate after taxes. Once you get there, every year you work will equal one year of living expenses. giphy

giphy

Anecdotal but still relatable.

MsIndyCroussett

MsIndyCroussett

This is probable.

AltmanErin

AltmanErin

And then everyone clapped.

hilaryagro

hilaryagro

Hold up.

robertoblake

robertoblake

Sometimes you gotta lie to get by.

lowericon

lowericon

Mars is far more likely.

RedHeadedAuthor

RedHeadedAuthor

As the tweet continued to make it's way through social media, people began to discuss the how and why saving is so difficult.

Facebook

Facebook

Highly unlikely even from Gen X perspective.

Facebook

Facebook

Sure, it sounds lovely. Doesn't it?

Facebook

Facebook

So. Much. Doubt.

Facebook

Facebook

This tomfoolery has gone on long enough.

Facebook

Facebook

Life is expensive ASF.

Facebook

Facebook

Just zip it, yo.

Facebook

Facebook

Savings? SAVINGS?

Facebook

Facebook